The EV market is expanding, but growth has slowed significantly in Europe and the US in the first half of 2024. A crucial step to reigniting growth is releasing more affordable models. While battery costs are often the primary focus, other components, such as electric motors, also offer significant opportunities for cost reduction.

IDTechEx’s latest report, “Electric Motors for Electric Vehicles 2025-2035: Technologies, Materials, Markets, and Forecasts,” explores the current landscape of electric motor technologies and materials, projecting future trends and demands over the next decade. According to the report, over 160 million electric motors will be required by the EV market in 2035, with 30% of the automotive market expected to adopt rare earth-free technologies.

Improving Motor Efficiency to Reduce Battery Costs

One way to reduce overall EV costs is through more efficient motors. Higher motor efficiency translates into more range for the same battery capacity, ultimately lowering battery costs. For instance, improving motor efficiency from 93% to 96% could reduce the energy required for a 75kWh vehicle by 2.9%, leading to approximately $200 savings in battery costs, assuming a battery price of $100/kWh.

Materials vs. Manufacturing Costs in Electric Motors

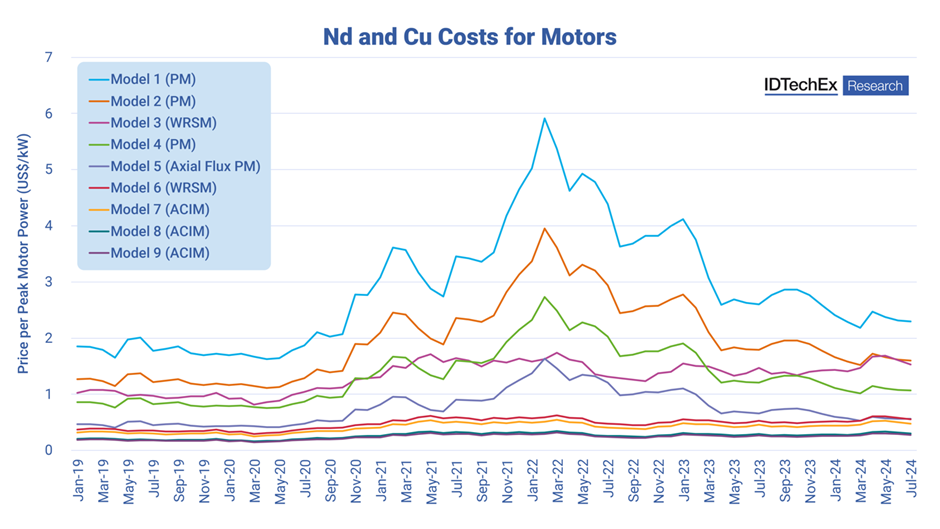

In 2023, permanent magnet (PM) motors accounted for 85% of the market for battery electric and plug-in hybrid cars. These motors use rare earth materials, which, although only a small part of the motor, can represent up to a third of the motor’s material costs. The price of rare earth elements like neodymium has fluctuated significantly, making the cost of these motors unpredictable.

Magnet-free motors, such as wound rotor synchronous motors (WRSM), offer an alternative by replacing permanent magnets with copper windings, reducing material costs. However, they come with higher manufacturing costs and lower efficiency, making them viable only when rare earth prices are high.

Another option is rare earth-free magnets, like ferrites or AlNiCo, which are cheaper but sacrifice performance. To compensate, larger motors may be required, making these options more suitable for low-performance vehicles, such as small city cars. The decision to switch away from rare earth magnets may also be driven by environmental concerns and supply chain security.

IDTechEx’s Predictions and Market Outlook

Despite these challenges, IDTechEx forecasts that by 2035, magnet-free motor technologies will occupy 30% of the automotive motor market, up from just 9% in 2023. As rare earth supply chain issues and price volatility continue to raise concerns, magnet-free technologies are expected to improve and become more attractive alternatives.

While the cost of the motor is not the primary driver of an EV’s overall cost, it plays a critical role. Innovation in motor technology is expected to continue, offering potential for further cost reductions.

Could Axial Flux Motors Be a Game Changer?

Axial flux motors could play a crucial role in the future of cost reduction due to their high power and torque density. They require less material per kW of power, which could lead to significant cost savings. However, these motors are not yet mass-produced at the scale required for the automotive market. Although they have the potential to be simpler to manufacture than traditional radial flux motors, they must first overcome established industry standards and find the right partnerships.

IDTechEx predicts growth in the axial flux motor market, but it will take time for these motors to achieve the scale typically seen in automotive technologies.

To explore more about the IDTechEx report, “Electric Motors for Electric Vehicles 2025-2035: Technologies, Materials, Markets, and Forecasts,” visit www.IDTechEx.com/Motors, where downloadable sample pages are available.